#How to Implement ESG Reporting Step-by-Step

Explore tagged Tumblr posts

Text

Learn how to implement ESG reporting with key frameworks like GRI, SASB, and CSRD. Ensure compliance, track KPIs, and improve sustainability efforts.

#ESG Compliance#ESG Framework#Sustainability Compliance#ESG Audit#ESG Strategy#ESG verification#Corporate ESG#Climate risk reporting#ESG data management#How to Implement ESG Reporting Step-by-Step

0 notes

Text

Energy Optimization Starts Here- Inside the Energy Audit in Dubai Process

Energy consumption is a major concern in the UAE, especially in a climate where air conditioning and lighting can consume significant power. For businesses and building owners in Dubai, reducing energy bills without compromising comfort is not just a financial decision it’s a sustainability goal.

This is where an Energy Audit in Dubai becomes an essential first step. Conducted by experienced professionals, an energy audit reveals where, how, and why energy is being wasted in your facility and how to fix it.

In this blog, we explore the energy audit process, its benefits, and how ENERGY SAVERS helps businesses become smarter and greener in Dubai.

What Is an Energy Audit?

An energy audit is a systematic assessment of a building’s energy flow. The goal is to identify areas where energy is lost and provide actionable recommendations to improve overall efficiency.

Auditors examine:

HVAC systems

Lighting and electrical usage

Insulation and building envelope

Equipment and machinery performance

Operating schedules

Utility bills and historical consumption data

Why Energy Audits Are Crucial in Dubai

Dubai’s climate demands heavy use of air conditioning and ventilation, especially in commercial, residential, and industrial buildings. Add to this rising energy tariffs and government push for greener practices, and energy efficiency becomes a necessity.

Here’s why an Energy Audit in Dubai is crucial:

Reduce utility costs

Improve occupant comfort

Achieve environmental compliance (Estidama, LEED)

Extend equipment life

Support Net Zero and ESG targets

Unlock hidden savings through better system performance

Types of Energy Audits Offered in Dubai

At ENERGY SAVERS, we offer different levels of audits tailored to your building size and energy complexity:

1. Preliminary Energy Audit

Low-cost, quick assessment

Basic site walk-through

Spot obvious energy wastage

Ideal for small businesses or as a starting point

2. General Energy Audit

Detailed review of utility bills and systems

Site measurements and interviews

Benchmarking against standards

Report with practical recommendations

3. Investment-Grade Audit

Comprehensive analysis including ROI calculations

Simulation-based modeling

Implementation roadmap

Best for larger facilities with significant energy use

Step-by-Step: The Energy Audit Process in Dubai

Here’s how ENERGY SAVERS conducts an energy audit:

Step 1: Initial Consultation

We assess your building type, energy goals, and concerns to customize the audit approach.

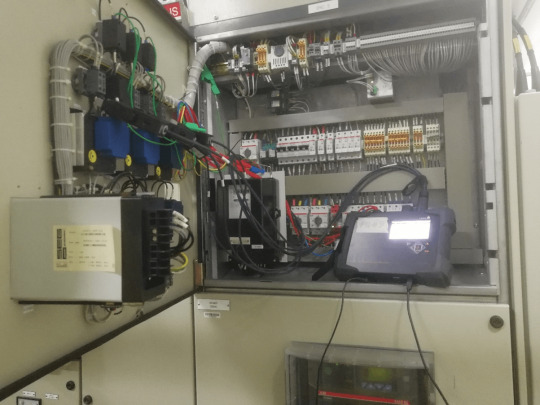

Step 2: Site Survey & Data Collection

Our auditors visit the site to collect data on:

Electrical systems

HVAC units

Lighting

Water heating

Occupancy schedules

We also request past utility bills for analysis.

Step 3: Analysis & Benchmarking

We analyze energy consumption patterns, compare them with similar buildings, and use software tools to simulate savings.

Step 4: Audit Report Delivery

You receive a detailed report with:

Energy performance summary

Wastage points

Recommended upgrades (with ROI)

Expected energy savings

Step 5: Action Plan & Support

We help you prioritize the recommendations, choose energy-efficient upgrades, and even implement them through our technical team.

Common Recommendations After an Energy Audit

Many facilities in Dubai see improvements by:

Upgrading to LED lighting

Optimizing HVAC scheduling and zoning

Installing occupancy sensors and timers

Sealing air leaks and insulation gaps

Replacing outdated motors or compressors

Integrating a Building Management System (BMS)

Case Study: 30% Savings for a Dubai Warehouse

A logistics company in Al Quoz contacted ENERGY SAVERS for an audit. Post-analysis, we implemented:

AC zoning based on occupancy

LED retrofitting

Improved insulation

Result? They reduced their monthly DEWA bill by 30% within six months.

Why Choose ENERGY SAVERS for Energy Audit in Dubai

We’re more than auditors we’re efficiency partners. With deep technical expertise and customized solutions, we offer:

Certified Energy Auditors

Decades of experience in UAE market

Advanced testing and measurement tools

Full-service implementation support

Proven results across commercial, industrial & residential buildings

Our Core Services

Energy Audit in Dubai

Power Quality Analysis

HVAC Optimization

Automation & BMS Integration

Lighting Efficiency Solutions

Renewable Energy Integration

BEST POWER QUALITY AND ENERGY EFFICIENCY SOLUTION IN DUBAI

ENERGY SAVERS is recognized across the UAE for delivering the Best Power Quality and Energy Efficiency Solution in Dubai. Our audits are designed not just to assess but to transform.

Small Changes, Big Impact

An Energy Audit in Dubai is the first step toward a leaner, greener, and smarter building. Whether you're running a hotel, office, or industrial site, the savings uncovered through a professional audit can lead to major operational gains.

Want to discover how much your building can save? Contact ENERGY SAVERS today to schedule a professional energy audit and take the first step toward a more sustainable future.

FAQ: Energy Audit in Dubai

1. What is the cost of an energy audit in Dubai?

The cost depends on building size and complexity. Basic audits are affordable, while investment-grade audits offer detailed ROI insights.

2. Is an energy audit mandatory in Dubai?

While not always mandatory, audits are encouraged to meet sustainability targets and government incentives.

3. How long does an energy audit take?

Typically, 1–5 days depending on the facility. Reports are delivered within a week post site survey.

4. Will the audit disrupt building operations?

No, audits are non-invasive. Our team works discreetly with minimal interference.

5. Do I have to implement all audit recommendations?

No, you can choose based on your budget and goals. We help prioritize the most impactful actions.

#Energy Audit in Dubai#Building Energy Efficiency#Energy Savers UAE#Power Quality Solutions#Best Power Quality and Energy Efficiency Solution in Dubai#energy management system in uae#ev charger in dubai#automation solution in uae

0 notes

Text

How Utility Bill Audits Can Uncover Hidden Costs for Industrial Facilities

In today's volatile energy market, industrial facilities face mounting pressure to reduce operating costs and increase energy efficiency. Utility bills are often seen as fixed overhead expenses, but the reality is quite different. Many businesses unknowingly overpay due to billing errors, incorrect rate classifications, or contract inefficiencies.

This is where a utility bill audit becomes a powerful cost-reduction tool — helping companies uncover hidden expenses, reclaim overcharges, and make smarter decisions about their energy use.

What is a Utility Bill Audit?

A utility bill audit involves a thorough review of your electric, gas, and water bills over a 12–36 month period. The goal is to analyze usage patterns, tariff applications, and billing accuracy. Auditors look for:

Incorrect rate codes

Inaccurate meter readings

Demand charge errors

Missed exemptions or rebates

Contract mismatches

At The Wasmer Company, we’ve seen industrial clients recover thousands of dollars in erroneous charges — and even more in long-term cost savings.

Why Utility Bill Errors Are So Common

Utility providers process millions of invoices, and even small clerical errors or incorrect classifications can go unnoticed for months. In sectors like manufacturing, food processing, or heavy industry, where utility consumption is high, even a minor rate issue can translate into tens of thousands in overpayments.

Moreover, many facilities are placed into default commercial rate structures, which are not optimized for their specific usage profile — leading to consistently inflated bills.

Wasmer's Utility Audit Process

At The Wasmer Company, we approach every audit with precision and transparency:

Data Collection – We gather 12 to 36 months of historical utility bills and contract documents.

Analysis – Our team of experts checks for inconsistencies, rate errors, and usage anomalies.

Reporting – We provide a detailed savings report highlighting all discrepancies.

Correction & Refunds – We work with the utility providers to secure refunds or adjustments.

Future Strategy – We recommend contract renegotiations or technology upgrades for ongoing savings.

And the best part? We only charge if we find you savings — making it a risk-free opportunity for your business.

Real Business Impact

Utility audits are not just about catching errors. They're also a strategic tool to:

Improve budgeting accuracy

Negotiate better energy procurement contracts

Benchmark efficiency across facilities

Meet sustainability and ESG targets

For many companies, the audit becomes a launching point for broader energy efficiency initiatives — from equipment upgrades to implementing renewable energy solutions.

Who Should Consider a Utility Bill Audit?

If your facility falls into any of the following categories, a utility audit is likely to benefit you:

Annual energy spend above $50,000

No audit conducted in the last 2–3 years

Facilities spread across multiple locations

Involvement in manufacturing, warehousing, or processing

Experiencing billing spikes or inconsistency

Why Choose The Wasmer Company?

With over 40 years of experience in industrial energy services, The Wasmer Company is a trusted partner for businesses looking to reduce operational costs and maximize efficiency.

We offer:

Industry-specific knowledge

Transparent reporting

Zero-risk audit approach

Personalized cost-saving strategies

Conclusion A utility bill audit isn’t just a financial cleanup — it’s a proactive step toward better energy management. If you haven’t reviewed your utility costs recently, you may be leaving money on the table.

Let The Wasmer Company help you uncover hidden costs and build a smarter energy future.

0 notes

Text

Sustainable Supply Chains Shaping Franchises

Franchise brands across the US are at a critical crossroads as pressure mounts from regulators, consumers, and investors to take meaningful action on supply chain sustainability. It’s no longer just about brand image — robust, eco-friendly supply chains have become the benchmark for brand strength, competitiveness, and preparedness for future expansion. Franchisors in various sectors are now reevaluating how they source materials, operate, and monitor their supply chains to stay competitive, differentiate themselves, and grow in an increasingly crowded market.

Regulations and New Franchise Standards

One major catalyst for this transformation is the US Securities and Exchange Commission’s (SEC) recent climate regulations. Publicly traded franchises (and their partners) are now required to measure and disclose greenhouse gas emissions, manage climate-related risks, and demonstrate genuine sustainability and transparency plans. These mandates align closely with significant international developments such as the EU’s reporting and due diligence regulations. Going forward, franchises cannot simply focus on the transactional side of buying and selling — they must exercise comprehensive oversight on suppliers and the environmental impact of every step in their operations.

Meeting these evolving requirements is challenging — it demands new procedures and detailed risk management strategies. Many franchises are collaborating with specialized consultants to accurately map their supplier networks, manage ESG (Environmental, Social, and Governance) data, and implement systems that enable reliable reporting. While the learning curve can be steep and some missteps expected, brands demonstrating commitment to progress are more likely to build trust with consumers and investors and avoid falling behind amid rapid industry shifts.

Eco-Friendly Supply Chain Practices

A recognizable trend is emerging among franchises aiming to expand while enhancing their environmental impact. Across industries, companies are embracing “green supply chain management,” meaning integrating sustainable practices at every touchpoint: vetting suppliers, adopting environmentally responsible manufacturing, using sustainable packaging, and optimizing distribution. It’s no longer limited to food franchises offering plant-based menu options or compostable packaging. Sectors such as cleaning, logistics, and delivery are transitioning to eco-friendlier chemicals, refining delivery routes, and reducing water and energy consumption in daily operations.

Technology plays a crucial role in this evolution. Automated inventory systems help minimize waste. Real-time data tracking pinpoints emission hotspots or opportunities to consolidate shipments for improved efficiency. The trend toward reverse logistics—where franchises retrieve used products for reuse, recycling, or refurbishment—is also growing, allowing brands to extend product lifecycles and deliver measurable reductions in waste and emissions.

Transparency and Team Approach

Stakeholders across the board—from regulators to institutional investors to everyday customers—demand transparency and clarity regarding how franchises address their environmental footprint. Replacing vague, generic “green” claims with concrete, honest ESG disclosures is becoming an industry norm. Increasingly, franchises are benchmarking their practices against industry leaders, continuously monitoring supplier risks, and seeking expert assistance to develop thorough reporting and employee training programs.

Success depends on making sustainability a collective responsibility rather than siloing it within a single department. Collaboration among teams in operations, compliance, and procurement is essential for advancing ESG initiatives, reducing emissions, implementing greener logistics solutions, and ensuring accurate data collection. Cross-functional training and collaboration prove critical to aligning routes, staff development, sourcing decisions, and vendor selection with the overarching goal of sustainable, responsible business practices.

Pioneers in Food, Service, and Tech

Leading examples from early adopters in food service and tech-powered franchises are setting new industry standards. Prominent eco-conscious restaurant brands build customer loyalty by openly sharing how they prioritize local sourcing, sustainable packaging, and eco-friendly menu selections. Meanwhile, cleaning, logistics, and delivery franchises are shifting towards certified green products and dramatically reducing resource use throughout their operations. Tech-driven franchisors leveraging AI and sophisticated automation can monitor and adjust business processes in real time, further cutting waste and boosting efficiency.

These success stories prove that sustainability isn’t a passing trend — it delivers concrete benefits. Brands focused on real, measurable progress gain stronger investor interest and deeper customer loyalty by moving beyond slogans. Early movers position themselves for the best access to future funding and growth opportunities as the market continues to prioritize green practices.

Action Steps Franchises Can Take Now

For any US franchise committed to leading in sustainability, here are tangible actions to consider:

Conduct a comprehensive mapping of your entire supply chain. Evaluate suppliers thoroughly for ESG risks—don’t overlook any challenging aspects.

Incorporate green procurement standards into contracts so that sustainable certifications are required from the start for new supplies and products.

Deploy digital tools for monitoring emissions and compliance continuously; the earlier you begin automating reporting, the smoother scaling becomes.

Ensure organizational alignment by investing in recurring sustainability training and interdepartmental learning, embedding an eco-conscious mindset across teams.

Develop or expand reverse logistics programs to increase product recycling and refurbishment rates, reducing landfill waste.

Commit to transparent, honest ESG reporting aimed at clients, investors, and regulators. Results and measurable outcomes always carry more weight than unsubstantiated claims.

Additionally, explore growth opportunities in depth. Closely monitor SEC developments alongside European regulations to stay ahead of upcoming requirements. Regular benchmarking against leading green franchises worldwide can mark the difference between remaining average and becoming a market exemplar. Plenty of room exists for improvement, and those that remain adaptable generally move more quickly and effectively.

Transitioning to sustainable supply chains is neither instantaneous nor without challenges. However, franchises that implement these practices—and continuously pursue innovation and refinement—will lead the way and secure sustained success well beyond 2025. What was once a competitive advantage is quickly becoming a baseline expectation. The encouraging news for franchises eager to evolve: building a sustainable future can start today.

#Sustainability #FranchiseGrowth #EcoFranchise #SupplyChain #USFranchising #GreenBusiness #ESG

Start your sustainable transformation—get expert franchise guidance at https://thefranchiseadvisor.com

0 notes

Text

Impact Evaluation of CSR Projects: Measuring What Truly Matters

The impact evaluation of CSR projects plays a pivotal role in determining the real effectiveness of a company’s Corporate Social Responsibility efforts. While launching CSR initiatives is important, understanding whether these initiatives are genuinely improving lives and communities is what gives CSR its true value.

Impact evaluation enables businesses to shift from focusing solely on outputs—like number of beneficiaries reached or materials distributed—to outcomes and long-term changes that align with sustainable development goals.

What Does Impact Evaluation Involve?

Impact evaluation is a comprehensive process used to assess the long-term results of CSR projects. It goes beyond routine monitoring and evaluation by identifying how a project has influenced the lives of individuals, communities, and ecosystems.

It answers critical questions such as:

What meaningful changes occurred as a result of the project?

Were those changes aligned with the original goals?

Are the changes likely to last after the project ends?

Benefits of Conducting an Impact Evaluation of CSR Projects

Evaluating CSR impact brings numerous advantages, allowing organizations to optimize their social investment and increase transparency.

Key benefits include:

Demonstrates accountability to donors, regulators, and stakeholders.

Improves project planning with data-driven insights.

Encourages responsible resource use and better budgeting.

Builds community trust and long-term engagement.

Ensures alignment with ESG (Environmental, Social, Governance) goals.

Steps to Conduct an Effective Impact Evaluation

For meaningful results, follow a structured process tailored to the nature of the CSR project:

1. Identify Goals and Impact Indicators

Start by clearly defining what success looks like and how it will be measured.

2. Collect Baseline Data

Gather pre-intervention data for comparison.

3. Monitor Progress

Track implementation activities at regular intervals.

4. Evaluate Post-Project Outcomes

Assess long-term results through surveys, interviews, and statistical analysis.

5. Share Learnings

Report findings transparently and integrate lessons into future CSR planning.

Tools and Approaches

Various tools can help conduct a robust impact evaluation of CSR projects, such as:

Community satisfaction surveys

Outcome mapping

Participatory rural appraisals (PRAs)

Theory of Change and logic models

Case comparisons and counterfactual analysis

Tips for Maximizing Impact Evaluation

To enhance the effectiveness of your CSR impact evaluation:

Include beneficiaries in the planning and evaluation stages.

Use a third-party evaluator for unbiased analysis.

Report results visually using dashboards and infographics.

Focus on sustainability—look beyond short-term success.

Link findings to corporate mission and SDG targets.

Conclusion

In today’s impact-driven world, the impact evaluation of CSR projects is no longer optional���it’s essential. It empowers companies to measure what truly matters, make smarter decisions, and ultimately contribute to lasting social good. When done right, impact evaluation transforms CSR from charity into strategic, measurable, and sustainable action.

#Impact Evaluation of CSR Projects#csr projects#microfinance institutions#impact assessment#csrindia

0 notes

Text

Understanding ISO 14064: A Guide to Greenhouse Gas (GHG) Management and Reporting

In today’s world, where climate change and environmental sustainability are top priorities, businesses are under increasing pressure to measure, manage, and reduce their greenhouse gas (GHG) emissions. One of the most recognized international standards for GHG accounting and verification is ISO 14064. This standard helps organizations accurately quantify and report emissions while building trust with stakeholders.

What is ISO 14064?

ISO 14064 is a globally accepted standard developed by the International Organization for Standardization (ISO) for greenhouse gas accounting and verification. It provides clear guidance to organizations on how to quantify, monitor, report, and verify GHG emissions and removals. The standard is divided into three parts:

ISO 14064-1: Specifies principles and requirements at the organization level for quantification and reporting of GHG emissions and removals.

ISO 14064-2: Focuses on GHG projects and provides guidance for quantifying, monitoring, and reporting emission reductions or enhancements of removals.

ISO 14064-3: Provides requirements and guidance for validating and verifying GHG assertions.

By implementing ISO 14064, companies can take a structured and transparent approach to managing their carbon footprint.

Why is ISO 14064 Important?

With increasing global concerns about environmental degradation and regulatory requirements around climate change, companies can no longer afford to ignore their environmental impact. Here’s why ISO 14064 is important:

Compliance: Aligns with global reporting frameworks such as the Carbon Disclosure Project (CDP), Science-Based Targets, and more.

Credibility: Offers a third-party verifiable approach that enhances the trustworthiness of GHG statements.

Risk Mitigation: Helps identify carbon-related risks and opportunities.

Market Demand: Consumers and investors increasingly prefer environmentally responsible organizations.

Who Should Implement ISO 14064?

ISO 14064 is suitable for any organization, regardless of its size, sector, or location, that wants to:

Demonstrate environmental responsibility.

Comply with national or international climate-related regulations.

Attract climate-conscious stakeholders and customers.

Integrate GHG emissions data into ESG and sustainability reporting.

Industries like manufacturing, construction, energy, transportation, FMCG, and agriculture find ISO 14064 particularly useful.

Key Benefits of ISO 14064 Implementation

1. Enhanced Transparency and Accountability

ISO 14064 allows organizations to transparently report their emissions data, increasing stakeholder confidence.

2. Supports Climate Action Goals

It helps organizations contribute to national and international targets, such as the Paris Agreement or Net-Zero Commitments.

3. Improved Efficiency

GHG reporting often highlights inefficiencies in energy or process management, providing opportunities for operational improvement.

4. Competitive Advantage

Certification to ISO 14064 demonstrates environmental leadership and can set your organization apart in tenders and sustainability indices.

5. Foundation for Carbon Credits or Offsetting

ISO 14064 provides a credible basis for trading carbon credits or participating in voluntary carbon offset programs.

ISO 14064 Implementation Process

At 4C Consulting, we simplify the ISO 14064 implementation process into the following key steps:

Step 1: Gap Assessment

Assess existing processes against ISO 14064 requirements.

Identify gaps and improvement areas.

Step 2: GHG Inventory Development

Define organizational and operational boundaries.

Identify direct and indirect emission sources (Scope 1, 2, and 3).

Calculate emissions using approved methodologies.

Step 3: Documentation & Internal Controls

Develop GHG inventory management plans.

Implement data collection systems and assign responsibilities.

Step 4: Training & Awareness

Train internal teams on GHG quantification, recordkeeping, and reporting practices.

Step 5: Internal Audit & Verification

Conduct internal audits to verify emission calculations.

Prepare for third-party validation as per ISO 14064-3.

Step 6: Certification & Continuous Improvement

Facilitate third-party verification or certification.

Establish a system for periodic monitoring and improvement.

How 4C Consulting Can Help

With 2500+ clients and over 15,000 hours of ISO training delivered, 4C Consulting brings deep domain expertise in implementing ISO standards, including ISO 14064.

Our expert consultants offer:

Tailored ISO 14064 Implementation

Assistance in developing a robust GHG Inventory

Preparation for third-party verification

Support with ISO 14064 audits and internal controls

Training and awareness programs for staff

End-to-end documentation support including ISO 14064 manual

We ensure a smooth, efficient, and cost-effective ISO 14064 implementation aligned with your organization’s goals and sustainability strategy.

#ISO 14064 Implementation#GHG Reporting Standard#Greenhouse Gas Management#ISO 14064 Certification#ISO 14064 Consultant#GHG Inventory#ISO 14064 Audit#GHG Verification Services#ISO 14064 Standard Requirements#Carbon Emission Reporting

1 note

·

View note

Text

Why Your Carbon Footprint Matters and How to Make Greener Decisions for a Healthier Earth

Knowing and controlling your carbon footprint has become essential for both individuals and organizations in an era where sustainability is no longer a choice but a necessity. A person, organization, event, or product's total greenhouse gas emission, whether direct or indirect, is referred to as their "carbon footprint." At this point, the role of a carbon footprint consultant becomes crucial. Working with a Carbon footprint consultant can help you create practical plans to reduce emissions and enhance your sustainability performance, regardless of whether you're a small firm looking to operate more sustainably or a corporation aiming to meet ESG targets. Let's examine the primary benefits of reducing your carbon footprint and the reasons it makes sense to collaborate with a carbon footprint expert in Dubai or the United Arab Emirates.

You can directly support international efforts to combat climate change by lowering your carbon footprint. Businesses can comply with global climate agreements, such as the Paris Agreement and the United Nations' Sustainable Development Goals (SDGs), by reducing their greenhouse gas emissions. Carbon footprint consultants in Dubai may help businesses navigate national and international environmental laws, ensuring complete adherence and encouraging ecologically conscious behavior. Businesses operating in the UAE must adjust to the new regulatory environments as the country makes significant progress in sustainability. To ensure your compliance, a seasoned Carbon footprint consultant In UAE will stay informed about legislative changes.

Optimizing energy use and increasing operational efficiency are common steps to lower your carbon footprint. Energy expenses can be significantly reduced by making minor adjustments, such as replacing outdated lighting systems, improving HVAC systems, or converting them to renewable energy sources. A Carbon footprint consultancy In UAE can thoroughly audit your energy use and carbon emissions. The consultant provides customized recommendations that yield both financial and environmental benefits, informed by the findings. Sustainability is a wise monetary choice because energy-efficient technology investments often yield substantial returns over time. For stakeholders, investors, and consumers alike, sustainability has emerged as a key value.

Reputations are enhanced by companies that proactively lower their carbon footprint and implement open reporting procedures. Working with a Carbon footprint consultant In Dubai provides you with the means to communicate your environmental achievements effectively. This can attract partners and customers who care about the environment, helping you stand out in crowded markets. Furthermore, sustainability is becoming a higher priority in global supply networks. Your company becomes a favored partner in worldwide trade and procurement networks by demonstrating its low-carbon plans. Environmental, social, and governance (ESG) considerations are becoming increasingly critical to investors. Funding from ESG-focused investors is more likely to be available to a business that demonstrates a commitment to reducing its carbon footprint.

You may measure, report, and validate your emissions data with the assistance of a trustworthy Carbon footprint consultancy. In addition to boosting investor trust, this transparency may pave the way for green bonds, loans connected to sustainability, and other financial incentives. Risks from climate change are serious and increasing. Businesses that disregard sustainability are increasingly vulnerable to supply chain disruptions caused by extreme weather and resource constraints. One method of risk mitigation is lowering your carbon footprint. Businesses can evaluate their vulnerability to climate hazards and create adaptation plans by collaborating with a carbon footprint consultant. Long-term profitability is ensured by these initiatives, which also improve resilience while lowering emissions.

Utilizing carbon reduction initiatives to demonstrate a strong commitment to the environment can enhance staff morale, increase retention, and attract top talent. Businesses may engage employees and cultivate a sustainability-driven workplace culture by implementing internal awareness campaigns and green initiatives with the assistance of a Carbon footprint consultant In UAE. Reducing your carbon footprint has several advantages for your business, and it's not just about protecting the environment. The benefits are obvious, ranging from cost savings and regulatory compliance to investor appeal and brand repute. Hiring a carbon footprint consultant in Dubai or around the United Arab Emirates offers the professional advice required to measure emissions, create reduction plans, and efficiently monitor results.

#Carbonfootprintconsultancy#Carbonfootprintconsultant#Carbonfootprintconsultancyindubai#Carbonfootprintconsultancyinuae#Carbonfootprintconsultantindubai#Carbonfootprintconsultantinuae

0 notes

Text

Nordex Global AS Empowering Growth: ESG-Focused Consulting for SMEs in Southeast Asia

Strategic Support by Nordex Global AS

In today’s fast-changing global market, small and medium-sized enterprises (SMEs) across Southeast Asia face growing pressure—not just to grow—but to grow sustainably, responsibly, and in compliance with international standards.

Nordex Global AS, a trusted ESG and strategic consulting firm, is dedicated to helping SMEs succeed. With deep experience in regional markets and a strong focus on ESG integration, regulatory compliance, and strategic execution, Nordex Global AS offers tailored, results-driven consulting services for SMEs that aim to thrive in Southeast Asia and expand into the European Union.

Targeted Consulting That Delivers Results

At Nordex Global AS, we recognize that small and medium-sized businesses don’t just need advice��they need practical, scalable solutions aligned with their size, industry, and goals. That’s why our services are personalized for two key segments:

Small Businesses: Building a Strong, Sustainable Foundation

Small enterprises often face unique barriers: limited capacity, lack of in-house ESG or compliance knowledge, and resource constraints. Nordex Global AS helps these businesses:

Understand ESG basics and align with EU buyer expectations

Improve operational efficiency and compliance documentation

Develop clear sustainability policies and risk frameworks

Prepare for ESG-related audits or supplier assessments

Identify growth paths with minimum risk and maximum impact

From startups to family-owned enterprises, we offer affordable, strategic guidance so your business can build a resilient foundation and take the next step toward regional or international growth.

Medium Enterprises: Scaling with Confidence and Compliance

For medium-sized businesses ready to scale, expand overseas, or professionalize their operations, Nordex Global AS provides a more advanced suite of services:

Strategic growth planning and market entry strategies

ESG integration aligned with CSRD, CBAM, or GRI reporting

Supply chain and procurement risk assessments

Policy creation and workforce sustainability development

Due diligence and stakeholder engagement programs

Whether you're expanding into Europe or strengthening your regional market share, we ensure that your business growth is future-proof, investor-friendly, and sustainability-aligned.

Sector-Wide Expertise for SMEs

Our consultants bring years of experience working with SMEs across a wide range of industries, including manufacturing, agriculture, technology, and consumer goods. In the manufacturing sector, we support clients in ensuring ethical sourcing, reducing waste, and increasing supply chain transparency. For agriculture and seafood businesses, we assist in implementing traceability systems, strengthening environmental safeguards, and meeting international food safety standards.

Within technology and services, we help companies drive policy innovation and position their brand around ESG values. For retail and consumer goods enterprises, our services include preparing for supplier audits, protecting labor rights, and developing sustainable packaging solutions. No matter the industry, Nordex Global AS delivers consulting strategies that bridge local challenges with global compliance requirements—particularly for businesses aiming to export to the European Union.

Why Choose Nordex Global AS?

ESG-First Approach: We specialize in ESG readiness, policy design, and audit preparation—especially for companies exporting to European markets where regulations are strict and evolving.

Custom Strategies for Every Stage: We don’t offer templates. Each strategy is based on real data, business needs, and EU trends that affect your industry and buyers.

In-Region Expertise: With deep insights into Southeast Asia’s business environment, labor laws, and supply chain dynamics, we understand your context—and how to move you forward.

Hands-On Support: From planning to execution, our consultants stay engaged to ensure implementation success and measurable outcomes.

Proven SME Track Record: Dozens of small and medium-sized businesses across ASEAN have trusted Nordex Global AS to transform their ESG practices and unlock market growth.

Partnering for Sustainable Growth

SMEs are the backbone of Southeast Asia’s economy—and increasingly, a focal point of EU importers and regulators. ESG compliance, smart strategy, and ethical operations are no longer optional; they are what define long-term success.

Whether you need consulting services for small businesses or growth and compliance support for medium enterprises, Nordex Global AS is your long-term partner in transformation.

🔗 Let’s Build the Future of Your Business, Together

Visit us: https://www.nordexglobal.com/

Explore ESG Solutions: https://www.nordexglobal.com/esg-business-solutions

0 notes

Text

What are the steps to obtain ISO 41001 Certification in USA?

What is ISO 41001 Certification?

ISO 41001 certification in USA 2018 is the worldwide standard for Office Administration Frameworks. It traces the forms, approaches, and hones essential to effectively overseeing buildings, frameworks, and related bolster administrations.

Certification to ISO 41001 illustrates that your organization:

Uses a steady and coordinated approach to office management

Improves efficiency and operational effectiveness

Supports maintainability, security, and inhabitant wellbeing

Why is ISO 41001 Certification Imperative in the USA?

With the ISO 41001 consultant in USA being domestic to millions of commercial, mechanical, and organizational buildings, the quality of office administration has a coordinated effect on:

Energy utilization and fetched control

Asset life-cycle management

Workplace wellbeing and safety

Environmental sustainability

Compliance with neighborhood and government regulations

ISO 41001 consultant in USA makes a difference in U.S. organizations moving from receptive, conflicting office operations to ISO 41001 consultant in USA a standardized, proactive framework that boosts long-term value.

Who Ought to Get ISO 41001 Certified?

ISO 41001 is perfect for:

Facility Administration (FM) companies

Hospitals and healthcare providers

Educational education and universities

Government and metropolitan buildings

Corporate central command and genuine domain groups

Logistics centers and fabricating plants

Whether you oversee or outsource offices in-house, this standard brings quantifiable benefits.

Key Benefits of ISO 41001 Certification in the USA

Moved forward operational control of buildings and back ISO 41001 consultant services in USA

Decreased vitality and upkeep costs

Bolster’s green building activities and ESG goals

Made strides in compliance with OSHA, ADA, EPA, and other regulations

Improved worker and tenant satisfaction

More ISO 41001 consultant services in USA grounded brand picture and competitive advantage

Steps to Accomplish ISO 41001 Certification in the USA

1. Crevice Analysis

Evaluate current office administration forms against ISO 41001 consultant services in USA requirements.

2. Arranging and Documentation

Develop the Office Administration Framework, counting arrangements, strategies, chance evaluations, and execution objectives.

3. Implementation

Roll out the framework over divisions and administrations. Prepare significant personnel.

4. Inner Review and Administration Review

Conduct inside reviews and administration audits to recognize enhancement openings and guarantee readiness.

5. Certification Audit

Undergo an outside review by an IAF-accredited certification body. If ISO 41001 auditor in USA effective, certification is granted.

Documents Required for ISO 41001 Certification

Facility administration approach and manual

Asset registers and upkeep logs

Risk evaluations and crisis plans

Staff parts, duties, and preparing records

Key execution markers (KPIs) and objectives

Audit reports and remedial activity plans

How Long Does It Take to Get Certified?

Certification timelines change, but on average:

Small organizations: 2 to 3 months

Medium to huge organizations: 4 to 6 months

Timeframes depend on preparation, office measurements, and several locations.

Cost of ISO 41001 Certification in the USA

The fetched ISO 41001 auditor in USA is affected by the following:

Number and measure of facilities

Scope and complexity of services

Internal asset availability

Certification body and expert fees

Typical taking a toll ranges from $10,000 to $50,000, counting usage, preparing, and reviewing services.

Validity and Support of ISO 41001 Certification

Validity: 3 years

Annual observation reviews are required to keep up compliance.

A recertification review is conducted each third year.

Why Factocert for ISO 41001 Certification in USA?

We provide the best ISO Consultants in USA who are knowledgeable and provide ISO consultant services in USA the best solutions. Kindly contact us at [email protected]. ISO Certification consultants in USA and ISO auditors in USA work according to ISO standards and help organizations implement ISO Certification with proper documentation.

For more information, visit ISO 41001 certification in USA

0 notes

Text

Unlocking Opportunities: How CSR Funding Companies Empower NGOs for a Better Tomorrow

In today’s evolving landscape of social impact, Corporate Social Responsibility (CSR) has become more than just a mandate — it’s a powerful tool for change. As businesses increasingly embrace their role in community development, CSR funding companies are stepping forward to support transformative projects led by NGOs and social enterprises. These collaborations not only fulfill legal obligations but also drive sustainable development across sectors like education, healthcare, and the environment.

This article explores the significance of CSR partnerships, the role of a reliable corporate social responsibility company, and how organizations like Devaaksh Foundation help bridge the gap between businesses and NGOs to channel meaningful impact.

Understanding the Role of CSR Funding Companies

CSR funding companies are organizations — public or private — that allocate a portion of their profits toward social and environmental causes. This is typically done in compliance with Section 135 of the Companies Act, 2013, which mandates companies meeting certain financial criteria to spend at least 2% of their net profits on CSR activities.

These companies often partner with credible NGOs to implement on-ground projects, creating a win-win situation. The NGO gains the much-needed financial support and visibility, while the corporate entity fulfills its social responsibility goals and enhances its brand image.

At Devaaksh Foundation, we specialize in aligning NGO projects with the objectives of CSR donors. With a strong network of CSR funding companies, we ensure that impactful initiatives find the right corporate support for execution and growth.

Why Partnering with a Corporate Social Responsibility Company Matters

For NGOs and grassroots organizations, identifying the right corporate social responsibility company is crucial. A strategic partnership goes beyond mere funding — it involves collaboration, accountability, and shared goals.

Devaaksh Foundation acts as a facilitator, ensuring both parties benefit from the association. We vet NGOs for transparency and impact, and we help corporates identify projects that align with their values and ESG (Environmental, Social, and Governance) goals. This approach fosters long-term partnerships and measurable outcomes.

Accessing CSR Fund for NGOs: Challenges and Solutions

Securing CSR fund for NGO projects can often be a daunting task. Many organizations face challenges such as limited outreach, lack of proposal writing skills, and inadequate reporting mechanisms. Additionally, corporates look for well-documented, compliant, and scalable projects.

This is where Devaaksh Foundation adds tremendous value. We help NGOs:

Develop compelling project proposals

Ensure legal and financial compliance

Create robust reporting and impact assessment frameworks

Build credibility and visibility among CSR funders

By providing end-to-end support, we increase the chances of NGOs receiving CSR grants that can significantly amplify their social impact.

The Rise of Environmental Corporate Social Responsibility

One of the most urgent needs of our time is environmental sustainability. From climate change to resource depletion, businesses are now more aware of their ecological footprint. As a result, environmental corporate social responsibility is gaining momentum.

CSR funding companies are now actively investing in green initiatives like:

Afforestation and biodiversity conservation

Waste management and recycling

Renewable energy projects

Water conservation and sanitation

Devaaksh Foundation has been instrumental in connecting NGOs working on environmental causes with companies looking to fulfill their green CSR goals. Our environmental projects are designed for scalability, community involvement, and measurable impact.

Why Choose Devaaksh Foundation?

With years of experience in the social sector, Devaaksh Foundation stands out as a trusted link between CSR funding companies and NGOs. Whether you’re a business looking to fulfill your CSR mandate or an NGO seeking financial support, we provide a reliable platform for collaboration.

Here’s what makes us different:

Expert team with deep sector knowledge

Customized matchmaking between corporates and NGOs

Transparent processes and due diligence

Focus on high-impact, scalable projects

We are committed to building partnerships that drive long-term change and create a more equitable society.

Final Thoughts

In a world where collaborative efforts are the key to sustainable development, the role of CSR funding companies cannot be overstated. By supporting the right projects and forming meaningful partnerships, these companies are helping NGOs bring about real change on the ground.

Whether it’s healthcare, education, or environmental corporate social responsibility, every initiative counts — and at Devaaksh Foundation, we make sure it gets the support it deserves.

0 notes

Text

How ESG Compliance Impacts Supply Chain Risk in Egypt

As ESG compliance becomes vital in supply chain risk management, businesses in Egypt must integrate Environmental, Social, and Governance (ESG) principles to meet global standards and stay competitive. Prioritizing sustainability, ethical labor, and transparency strengthens supply chains, mitigates risks, and enhances investor and consumer trust. Failure to comply can result in reputational damage and legal penalties, while proactive ESG alignment drives efficiency and global partnerships.

So, how can Egyptian businesses adapt to these shifting demands? In this article, we’ll explore how ESG compliance influences supply chain risk management, the challenges businesses face, and practical steps they can take to align with global best practices.

The Growing Importance of ESG in Supply Chain Risk Management

Egypt’s economy is driven by industries such as manufacturing, construction, agriculture, and logistics—all of which rely heavily on complex supply chains. However, with increasing global trade regulations, investor expectations, and consumer awareness, companies can no longer ignore ESG compliance.

Failure to integrate ESG risk management into supply chains can lead to:

Regulatory penalties due to non-compliance with environmental and labor laws

Reputational damage from unethical supply chain practices

Operational disruptions caused by environmental hazards or poor governance

Financial instability due to a lack of responsible sourcing and supplier transparency

How ESG Factors Influence Supply Chain Stability in Egypt

1. Environmental Risks: The Push for Sustainable Supply Chains

Egypt’s industries are under growing pressure to adopt sustainable business practices. With increasing global climate regulations and sustainability mandates, companies must address carbon emissions, energy consumption, and waste management across their supply chains.

Key environmental risks in Egypt’s supply chains include:

High carbon footprints due to energy-intensive manufacturing and logistics

Water scarcity concerns affecting industries like agriculture and textiles

Waste management challenges due to poor recycling and disposal practices

Climate-related disruptions such as extreme weather events impacting supply routes

How to Mitigate Environmental Risks:

Implement green procurement strategies, choosing suppliers that follow sustainability guidelines

Monitor carbon emissions across the supply chain to meet international reporting standards

Reduce waste generation through recycling, circular economy practices, and sustainable packaging

Partner with ESG-compliant suppliers to align with global sustainability initiatives

2. Social Risks: Ensuring Ethical Labor & Human Rights Compliance

Social responsibility is a critical component of ESG compliance, particularly in Egypt, where supply chains often involve multiple tiers of suppliers, subcontractors, and workforce challenges. Companies operating in industries such as textiles, construction, and agriculture must ensure that their supply chains are free from forced labor, child labor, and unsafe working conditions.

Key social risks in supply chains include:

Unethical labor practices such as low wages and unsafe working environments

Supplier non-compliance with fair labor laws and human rights regulations

Health & safety concerns for workers in hazardous industries

Diversity & inclusion issues within supplier organizations

How to Address Social Risks:

Conduct supplier due diligence to assess labor practices and compliance with international standards

Implement worker safety programs to reduce health risks in manufacturing and logistics

Ensure fair wages and ethical employment practices across the supply chain

Collaborate with ESG-compliant suppliers who adhere to international labor laws

3. Governance Risks: Strengthening Compliance & Transparency

Governance risks in supply chains stem from weak internal controls, corruption, and lack of transparency. In Egypt, where regulatory frameworks are continuously evolving, businesses must ensure strict corporate governance to maintain supply chain integrity.

Key governance risks include:

Lack of supplier transparency, leading to fraud and financial mismanagement

Inadequate compliance with local and international trade laws

Corruption and unethical business practices within supplier networks

Cybersecurity risks related to supply chain data management

How to Strengthen Governance in Supply Chains:

Use data-driven supply chain risk management solutions to assess supplier credibility

Conduct regular audits and compliance checks to prevent fraud and corruption

Implement contract management systems to enforce supplier accountability

Strengthen cybersecurity measures to protect supply chain data from breaches

How D&B Helps Businesses in Egypt Strengthen ESG Compliance in Supply Chains

For businesses navigating supply chain risk management in Egypt, Dun & Bradstreet (D&B) offers a range of solutions to ensure ESG compliance, risk assessment, and supplier transparency.

1. ESG Ratings & Supplier Due Diligence

D&B provides comprehensive ESG risk assessments, helping businesses evaluate supplier sustainability, ethical practices, and governance policies. This ensures companies only partner with suppliers who meet international compliance standards.

2. Real-Time Risk Monitoring & Data Analytics

D&B’s risk intelligence tools allow businesses to monitor ESG-related risks in real time. This includes tracking environmental impact reports, supplier labor practices, and governance issues, ensuring proactive risk management.

3. Regulatory Compliance Support

D&B helps businesses stay ahead of changing ESG regulations by providing data-driven compliance reports and risk insights, ensuring supply chain partners meet global standards.

4. Supplier Risk & Financial Stability Analysis

D&B’s supplier evaluation solutions help companies assess the financial health and sustainability commitments of their supply chain partners, reducing the risk of supplier failures and operational disruptions.

Final Thoughts

As ESG compliance becomes a non-negotiable factor in global supply chains, businesses in Egypt must adapt to new sustainability, ethical, and governance standards to remain competitive. The key to success lies in proactive risk management, data-driven decision-making, and strategic supplier partnerships.

With D&B’s expertise in supply chain risk management, companies can navigate ESG complexities, ensure regulatory compliance, and build resilient supply chains that drive long-term growth.

#riskmanagement#leadgeneration#supplychainriskmanagement#financialriskmanagement#complianceregulations#d&bcreditreports#legalandregulatorycompliance#supplierduediligence

0 notes

Text

Demystifying Sustainability Reporting Guidelines: A Roadmap for Responsible Business

In a rapidly evolving global economy, sustainability is no longer a peripheral concern—it's a strategic imperative. Businesses beyond sectors are under increasing pressure from regulators, investors, and consumers to demonstrate transparency, environmental responsibility, and ethical practices. Sustainability reporting has emerged as a powerful tool to meet these expectations, enabling organisations to communicate their environmental, social, and governance (ESG) performance effectively.

As reporting frameworks become more sophisticated, many companies are turning to carbon footprint consultancy firms for expert guidance on how to align their reporting practices with global standards.

What is Sustainability Reporting?

Sustainability reporting is the disclosure of information regarding an organisation’s ESG impacts and performance. These reports are intended to provide stakeholders—shareholders, regulators, employees, and the public—with insights into how a company manages risks and opportunities related to sustainability.

Unlike financial reporting, sustainability reporting encompasses non-financial system of measurement such as greenhouse gas (GHG) emissions, energy consumption, water use, labour practices, and community engagement. It serves as both a management tool and a communications platform.

Key Sustainability Reporting Frameworks

To ensure consistency and comparability, organisations rely on globally recognised reporting frameworks. Each prepares a structure to capture and disclose data transparently:

Global Reporting Initiative (GRI): One of the most widely used frameworks, GRI provides comprehensive values for reporting on economic, environmental, and social impacts.

Sustainability Accounting Standards Board (SASB): Focuses on sector-specific disclosures that are financially material to investors.

Task Force on Climate-related Financial Disclosures (TCFD): Emphasises climate-related financial risk, urging businesses to disclose how climate change affects their strategy and financial planning.

Integrated Reporting (<IR>): Combines financial and non-financial information to give a holistic view of an organisation’s value creation.

Corporate Sustainability Reporting Directive (CSRD): An EU regulation that mandates detailed ESG discoveries aligned with the European Sustainability Reporting Standards (ESRS).

A carbon footprint consultancy can help companies navigate these frameworks, select the most appropriate ones, and align them with internal sustainability strategies.

Why Carbon Footprint Reporting Matters

At the heart of environmental disclosures lies carbon footprint reporting—a key indicator of a company’s contribution to climate change. It involves determining GHG emissions across three scopes:

Scope 1: Direct emissions from owned or controlled sources.

Scope 2: Indirect emissions from the generation of purchased energy.

Scope 3: All other indirect emissions in the value chain, including supply chain, travel, and waste.

A carbon footprint consultancy plays a critical role in helping organisations quantify their emissions, identify reduction prospects, and communicate their carbon implementation to stakeholders. Accurate carbon data is also foundational for setting science-based targets and aligning with net-zero commitments.

Steps to Develop a Sustainability Report

Creating a meaningful sustainability report involves a series of structured steps:

Stakeholder Engagement: Identify key stakeholders and understand their expectations around ESG issues.

Materiality Assessment: Determine the most significant ESG topics that impact both the business and its stakeholders.

Data Collection & Analysis: Gather variable and qualitative data on material issues—this is where a carbon footprint consultancy often adds value by ensuring accuracy and compliance with protocols like the GHG Protocol.

Framework Selection: Choose appropriate reporting standards (GRI, SASB, TCFD, etc.) based on stakeholder requirements and industry practices.

Drafting the Report: Structure the report around themes such as climate action, governance, social equity, and innovation, sponsored by performance data and case studies.

Third-Party Assurance (Optional): Independent assurance enhances the credibility of the report and is increasingly preferred by investors.

Publication & Communication: Release the report through multiple channels and engage stakeholders with its insights.

The Role of Carbon Footprint Consultancy

A specialised carbon footprint consultancy supports organisations at every stage of the sustainability reporting process—from defining carbon baselines to preparing Scope 3 emission supplies and integrating climate risk admissions into annual reports. They also help businesses align with standards like ISO 14064, CDP, and the Science Based Targets initiative (SBTi).

Such consultancies bring deep domain expertise, access to advanced tools, and an understanding of talented regulatory trends—helping organisations future-proof their sustainability strategies.

The Strategic Benefits of Reporting

Besides fulfilling compliance requirements, sustainability reporting provides several business benefits:

Improved Risk Management: Identifying ESG risks early helps mitigate future liabilities.

Enhanced Brand Value: Transparent reporting boosts corporate reputation and consumer trust.

Investor Confidence: Institutional investors increasingly rely on ESG disclosures for decision-making.

Operational Efficiency: Identifying energy and resource inefficiencies can lead to cost savings.

Conclusion

Sustainability reportage is no longer just a public relations exercise—it’s a cornerstone of responsible corporate governance and long-term value creation. For companies looking to further their ESG performance and communicate their climate action journey with authenticity, partnering with a reputable carbon footprint consultancy is a strategic move.

As global standards evolve and stakeholder expectations grow, businesses that invest in robust sustainability reporting will be superior stood to lead in a low-carbon, robust future.

0 notes

Text

EPR Consultancy in India- Induce India

EPR Consultancy in India: Driving Responsible E-Waste Management with Induce India

India is rapidly becoming one of the largest consumers of electronic devices in the world. This growth, while promising for digital advancement, has led to a parallel increase in electronic waste—posing serious environmental and regulatory challenges. In this context, Extended Producer Responsibility (EPR) has emerged as a critical legal and environmental framework.

At the forefront of this transformation is Induce India, a leading EPR consultancy in India, helping businesses of all sizes navigate regulatory requirements and adopt sustainable waste management practices.

Understanding EPR and Its Role in India

EPR is a policy mechanism under which producers of electrical and electronic equipment (EEE) are made responsible for the end-of-life management of their products. In India, the E-Waste (Management) Rules, 2016—amended in 2022—mandate that producers, importers, and brand owners must take measurable action to collect, recycle, or safely dispose of their products once consumers discard them.

The goal of EPR is not just regulatory compliance, but also to reduce the environmental footprint of e-waste and encourage responsible product lifecycle management. However, for many organizations, the complexity of compliance makes expert consultancy essential.

Why EPR Compliance Is Crucial for Businesses

Failure to comply with EPR regulations can result in substantial fines, bans on product sales, or reputational damage. But beyond regulatory concerns, EPR compliance offers significant advantages:

Improved Brand Reputation: Today’s consumers are more environmentally conscious than ever. Demonstrating responsibility through EPR can enhance brand credibility.

Investor Confidence: Companies that align with environmental, social, and governance (ESG) goals are increasingly favored by global investors.

Operational Efficiency: Proper e-waste management reduces risk and enhances supply chain transparency.

Long-term Cost Savings: Well-managed recycling programs can lead to savings in raw material procurement and waste disposal.

The Role of Induce India in EPR Implementation

Induce India provides comprehensive EPR consultancy services that address the entire lifecycle of compliance—from planning and registration to reporting and auditing. Their approach is rooted in legal precision, operational efficiency, and sustainability leadership.

1. EPR Registration and Documentation

The first step in the compliance journey is registering with the Central Pollution Control Board (CPCB). Induce India assists businesses with compiling necessary documentation, drafting EPR plans, and submitting applications. Their team ensures all submissions align with current rules, reducing the likelihood of delays or rejections.

2. Designing End-to-End E-Waste Management Systems

EPR doesn’t stop at paperwork. Producers are also required to establish a robust system for the collection, transportation, and recycling of e-waste. Induce India works with a nationwide network of authorized recyclers, dismantlers, and logistics providers to build compliant reverse logistics systems tailored to each client.

3. Compliance Monitoring and Reporting

Once an EPR plan is approved, producers must regularly report on their collection targets and recycling performance. Induce India offers monitoring and audit support, helping clients track progress, generate detailed reports, and stay compliant over time.

4. Stakeholder Awareness and Training

To ensure long-term success, Induce India supports awareness campaigns and stakeholder training programs. These initiatives help inform distributors, retailers, and consumers about the importance of safe disposal and how to participate in recycling programs.

Tailored EPR Solutions for Every Industry

Induce India serves a diverse clientele across multiple sectors, including:

Consumer Electronics and Appliances

Lighting and Electrical Equipment

IT Hardware and Telecom

E-commerce and Retail Platforms

Battery and Packaging Industries (where applicable under EPR rules)

Each industry has unique obligations and challenges under EPR norms. Induce India delivers customized compliance strategies that reflect specific industry regulations and operational realities.

Challenges in E-Waste Management—and How Induce India Solves Them

Despite regulatory backing, EPR enforcement in India faces several obstacles:

Low Public Awareness: Many end-users are unaware of how or where to dispose of e-waste responsibly.

Informal Sector Dominance: A large portion of e-waste is still handled by unregulated entities, often with environmentally damaging practices.

Lack of Infrastructure: Many regions lack access to certified recycling facilities.

Fragmented Collection Systems: Without coordinated logistics, collection targets become difficult to meet.

Induce India addresses these pain points through a blend of strategy and execution. Their partnerships with authorized recyclers, focus on consumer awareness, and tech-enabled tracking systems help bridge the gap between policy and practice.

Going Beyond Compliance: A Strategic Advantage

EPR isn’t just about avoiding fines—it’s about embracing a sustainable business model. With increasing scrutiny from regulators, consumers, and investors, EPR can become a competitive differentiator. Induce India empowers businesses to:

Set measurable sustainability goals

Align with global ESG benchmarks

Build transparent, traceable supply chains

Position themselves as leaders in environmental responsibility

By choosing Induce India, businesses are not only ensuring compliance but are also shaping a resilient, responsible future.

Real-World Impact and Success

Induce India has helped numerous organizations—from startups to multinational corporations—achieve EPR compliance efficiently. Clients often see improvements in operational transparency, stakeholder engagement, and even product innovation as a result of better e-waste strategies.

Their success stories demonstrate the value of proactive, informed consultancy in driving real change in waste management and environmental protection.

Preparing for the Future of EPR in India

As India updates and expands its EPR regulations—including newer categories like batteries and plastics—the need for expert guidance will continue to grow. Companies that stay ahead of these changes will avoid regulatory shocks and maintain long-term sustainability.

Induce India remains committed to staying ahead of policy trends, ensuring clients are always prepared for the next step in India’s environmental evolution.

Get Started with Induce India

For any business seeking clarity, compliance, and confidence in their EPR obligations, Induce India is the ideal partner. Their end-to-end support, technical expertise, and commitment to sustainability make them a trusted name in India’s green transformation.

To learn more about Induce India’s EPR consultancy services or to begin your compliance journey, visit: https://induceindia.com/service/e-waste-management-epr

0 notes

Text

The Future of Accounting: Trends to Watch in 2025

Accounting is no longer just about balancing books and filing taxes. With technology evolving at a rapid pace and business needs becoming more complex, the role of accounting professionals is undergoing a major transformation. As we step deeper into 2025, several trends are shaping the future of the industry—and it’s clear that adaptability and innovation will be key.

Here’s a look at the top accounting trends to watch in 2025, and how they’re reshaping the landscape for firms, freelancers, and finance teams alike.

1. AI and Automation Are the New Norm

In 2025, routine accounting tasks like data entry, invoice processing, and bank reconciliations are increasingly handled by artificial intelligence and robotic process automation (RPA). These tools not only boost efficiency but also reduce human error.

What This Means:

Accountants will spend less time crunching numbers and more time interpreting them.

There’s a growing demand for tech-savvy professionals who can manage and analyze automated data.

2. Rise of Advisory Services

With automation handling the basics, clients expect more value from their accountants. As a result, many firms are pivoting toward strategic advisory services—helping businesses with budgeting, forecasting, tax planning, and long-term financial strategy.

Key Takeaway:

Accountants are becoming trusted advisors, not just service providers.

3. Cloud-Based Accounting Is Now Essential

Gone are the days of desktop-based software and physical file cabinets. Cloud accounting tools like QuickBooks Online, Xero, and FreshBooks have made it easier than ever to manage finances from anywhere, at any time.

Why It Matters:

Real-time data access enables faster decision-making.

Remote collaboration between clients and accountants is more seamless.

4. Data Analytics Is Driving Decisions

Accountants are leveraging powerful data visualization and analytics tools to provide insights—not just reports. In 2025, firms that offer real-time dashboards, trend analysis, and predictive modeling will have a major competitive edge.

Tools to Watch:

Power BI

Tableau

Fathom

Spotlight Reporting

5. ESG Reporting and Sustainability Accounting

Environmental, Social, and Governance (ESG) metrics are becoming a standard part of financial reporting. Investors, regulators, and consumers are demanding more transparency around a company’s impact—and accountants are at the center of this shift.

Trend Alert:

New frameworks like SASB and TCFD are shaping ESG disclosures.

Accountants with ESG expertise are in high demand.

6. Increased Focus on Cybersecurity and Compliance

As digital tools multiply, so do cybersecurity risks. In 2025, accounting firms must invest in data security measures to protect sensitive financial information—and comply with tightening regulations like GDPR and evolving IRS protocols.

What to Do:

Conduct regular cybersecurity audits

Implement multi-factor authentication

Train staff on data protection best practices

7. Generative AI and Chatbots for Client Interaction

Generative AI (like ChatGPT!) is now being integrated into client communication and support systems. Firms are using AI-powered tools to answer client questions, automate document generation, and even assist in financial analysis.

Bonus Insight:

Expect to see AI-powered virtual accountants for basic tasks and customer service roles.

Final Thoughts

The accounting profession in 2025 is about so much more than numbers. It’s about insights, strategy, and technology. Whether you’re a solo practitioner, part of a growing firm, or running a finance team, staying ahead of these trends will be essential for long-term success.

The future of accounting is digital, advisory, and data-driven—and it’s already here.

0 notes

Text

Top 5 Portfolio Strategies for 2025: Maximize Your Returns [Expert Picks]

The financial landscape is evolving fast — and if your portfolio management strategies are still stuck in 2020, you’re likely missing out on real growth opportunities. With 2025 just around the corner, investors must rethink and realign their portfolios based on current data, emerging risks, and new technologies. Whether you're a seasoned investor or just beginning your wealth-building journey, strategic portfolio management in Gurgaon and other financial hubs across India is becoming increasingly vital. Here are five powerful strategies to guide your next move.

1. Dynamic Asset Allocation Based on Life Goals

Gone are the days of static investing. One of the strongest portfolio management strategies for 2025 is goal-based allocation. Whether you're saving for retirement, a second home, or your child's education — your investments must align with specific, measurable outcomes.

How to implement:

Map your goals across time horizons: short (1-3 years), medium (3-7 years), and long term (7+ years).

Allocate risk accordingly — equities for long-term goals, fixed income for short-term.

Review your portfolio every six months.

Pro Tip: Use digital tools or professional Portfolio Management Services to automate and optimize your allocations.

2. Embrace Thematic and Sectoral Trends

According to recent portfolio management trends published in 2024 by BlackRock and Morningstar, sectors like clean energy, health tech, and AI-based businesses are projected to outperform broader indices.

Why it works:

Thematic investing helps you ride long-term macroeconomic and technological trends.

You can gain exposure through mutual funds, ETFs, or PMS.

Be Cautious: This approach carries higher risk — balancing it with core holdings is essential.

3. Risk Parity and Tactical Rebalancing

Traditional 60:40 equity-debt models are now outdated. In 2025, successful investors are adopting risk parity models — where risk is evenly distributed across asset classes instead of capital.

Steps to apply this strategy:

Measure volatility of each asset in your portfolio.

Reallocate funds to ensure no single asset dominates your risk profile.

Consider rebalancing quarterly based on market shifts.

For investors in rapidly growing cities like Gurgaon, where HNIs and professionals are increasingly seeking sophisticated models, Portfolio Management in Gurgaon is seeing rising demand for such dynamic strategies.

4. Sustainable and ESG Investing

Sustainability is no longer a buzzword — it's a performance metric. MSCI’s 2024 report shows that ESG-focused funds delivered higher risk-adjusted returns than traditional ones.

Why ESG works:

Companies with strong governance and ethical practices outperform during downturns.

Investors are rewarded with stability and long-term value creation.

Add ESG screening to your portfolio management strategies to align your investments with your values and maximize returns.

5. Leverage AI for Predictive Rebalancing

AI isn’t just changing how we work — it's transforming how we invest. AI-powered tools use algorithms to:

Predict market corrections

Suggest ideal buy/sell timing

Personalize asset allocation based on your risk appetite

2024 saw the rise of AI-based Portfolio Management Services across India, especially in fintech-forward cities like Bangalore and Gurgaon.

Final Thoughts

Adapting your portfolio management strategies to reflect 2025’s realities is no longer optional — it’s the only way to stay ahead. Diversification, goal alignment, risk mitigation, sustainable investing, and AI-backed insights are the tools modern investors need to win.

Take the Next Step with BellWether

At BellWether, we don’t just manage portfolios — we help build financial legacies. Whether you're a growth-focused investor or looking for long-term wealth preservation, our tailored Portfolio Management Services combine the best of market intelligence, trend analysis, and personalized strategy. Based in India, we also offer specialized Portfolio Management in Gurgaon for professionals and HNIs.

What are the best portfolio management strategies for 2025?

The top strategies include diversification across asset classes, goal-based investing, risk-managed tactical allocation, sustainable investing, and AI-driven rebalancing. These approaches help investors stay agile and maximize returns in 2025.

FAQs

1. How often should I update my portfolio management strategy? Ideally, review your portfolio every 6 months. However, if there's a major life event or market disruption, adjust your strategy accordingly.

2. Are Portfolio Management Services suitable for first-time investors? Yes. Modern PMS platforms now offer entry-level options, and professional guidance helps beginners avoid costly mistakes while maximizing early gains.

3. What’s the minimum investment for portfolio management in Gurgaon? While it varies, most PMS providers in Gurgaon offer services starting at ₹25 lakhs. However, some firms have bespoke solutions for smaller portfolios.

4. How is ESG investing different from regular investing? ESG investing filters companies based on environmental, social, and governance criteria. It focuses on long-term ethical returns rather than short-term profits.

5. Is AI reliable for managing portfolios? AI enhances data analysis and decision-making but should complement, not replace, human judgment. At BellWether, we blend both for smarter portfolio outcomes.

#portfolio management strategies#investing in 2025#portfolio management trends#BellWether#portfolio advice#AI investing#wealth building

0 notes

Text

5 Key Trends of GRC and Its Future

Introduction:

Governance, Risk, and Compliance (GRC) have become critical components of Australian businesses, ensuring organisations adhere to regulations, manage risks effectively, and maintain ethical governance. With evolving workplace regulations in Australia, businesses must stay ahead of compliance changes to avoid penalties and reputational impacts.

What is GRC and Why Does It Matter?

GRC refers to a centralised strategy that helps businesses manage risks, adhere to regulations, and fulfil governance standards. It ensures that organisations operate ethically, minimise legal liabilities, and create a transparent business environment.